The Carrying Amount of an Asset Is Equal to the

Equal to the balance of the related accumulated amortization account. A liabilitys tax base is the carrying amount of the liability less any.

B no gain or loss on disposal is recorded.

. Assets cost less accumulated depreciation. Transcribed image text. These factors may not reflect what the asset would sell for.

The unit included the following assets. Which statement is true when a financial asset at FVOCI is reclassified to FVPL. If the carrying amount of an asset equals its selling price at the date of sale then a a gain on disposal is recorded.

The carrying amount is usually not included on the balance sheet as it must be calculated. An assets tax base is the amount that will be deductible for tax purposes in future periods once the economic benefits of the asset have been realized and a company can recover its carrying amount. Since in the exchange of plant asset Transit Co.

Force the carrying amount of the asset to equal its newly-revalued amount by proportionally restating the amount of the accumulated depreciation. Carrying value of a fixed asset also called book value is the amount at which a fixed asset is appears on a balance sheet. If it is not taxable the tax base and the carrying amount of the dividends receivable are equal.

When a financial asset at FVPL is reclassified to FVOCI the new carrying amount is equal. Assets cost less residual value less accumulated depreciation. When a financial asset at FVPL is reclassified as FVOCI the new carrying amount is equal to Date of record It is the date on which the stock and transfer book of.

The associated account Accumulated Depreciation has a credit balance of 43000. Received equipment with a fair value equal to the carrying amount of equipment given up. Assets cost less accumulated depreciation.

Fair value is the book value of an asset that is depreciated over the useful life of the asset. Question 9 1 point The carrying amount of an asset is equal to the assets fair value less its original cost. The carrying amount or carrying value of the receivables is 81000.

If the carrying amount of an asset equals its selling. The carrying amount is the original cost adjusted for factors such as depreciation or damage. The carrying amount of building after impairment loss is.

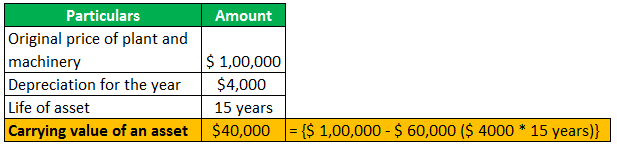

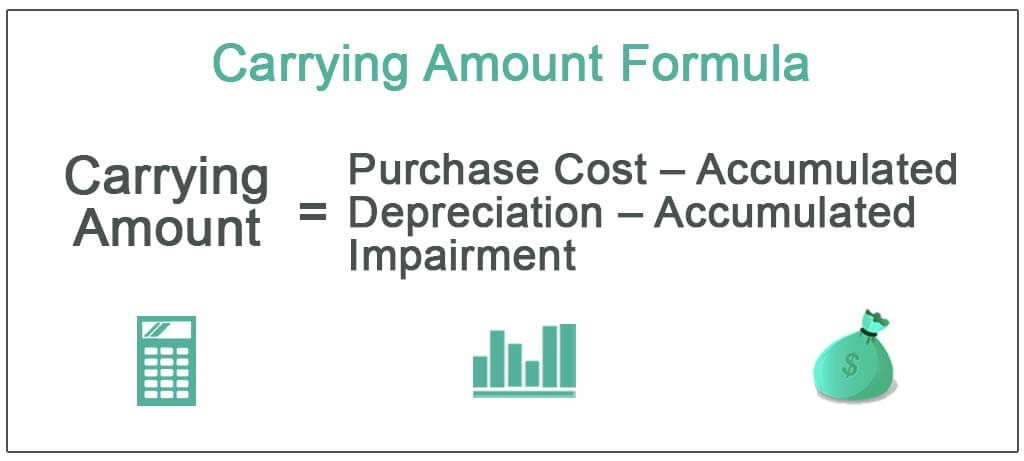

Carrying amount also known as carrying value is the cost of an asset less accumulated depreciation. At this point there is no gain or loss. Eliminate the accumulated depreciation against the gross carrying amount of the newly-revalued asset.

The trucks carry amount or book value is 7000. The Tax Base of a Liability. Present value of contractual cash flows d.

Fair value at reclassification date b. An example is dividends receivable from a subsidiary. If the fair value of the underlying asset is instead equal to its carrying amount then defer the initial direct costs and include them in the measurement of the lessors investment in.

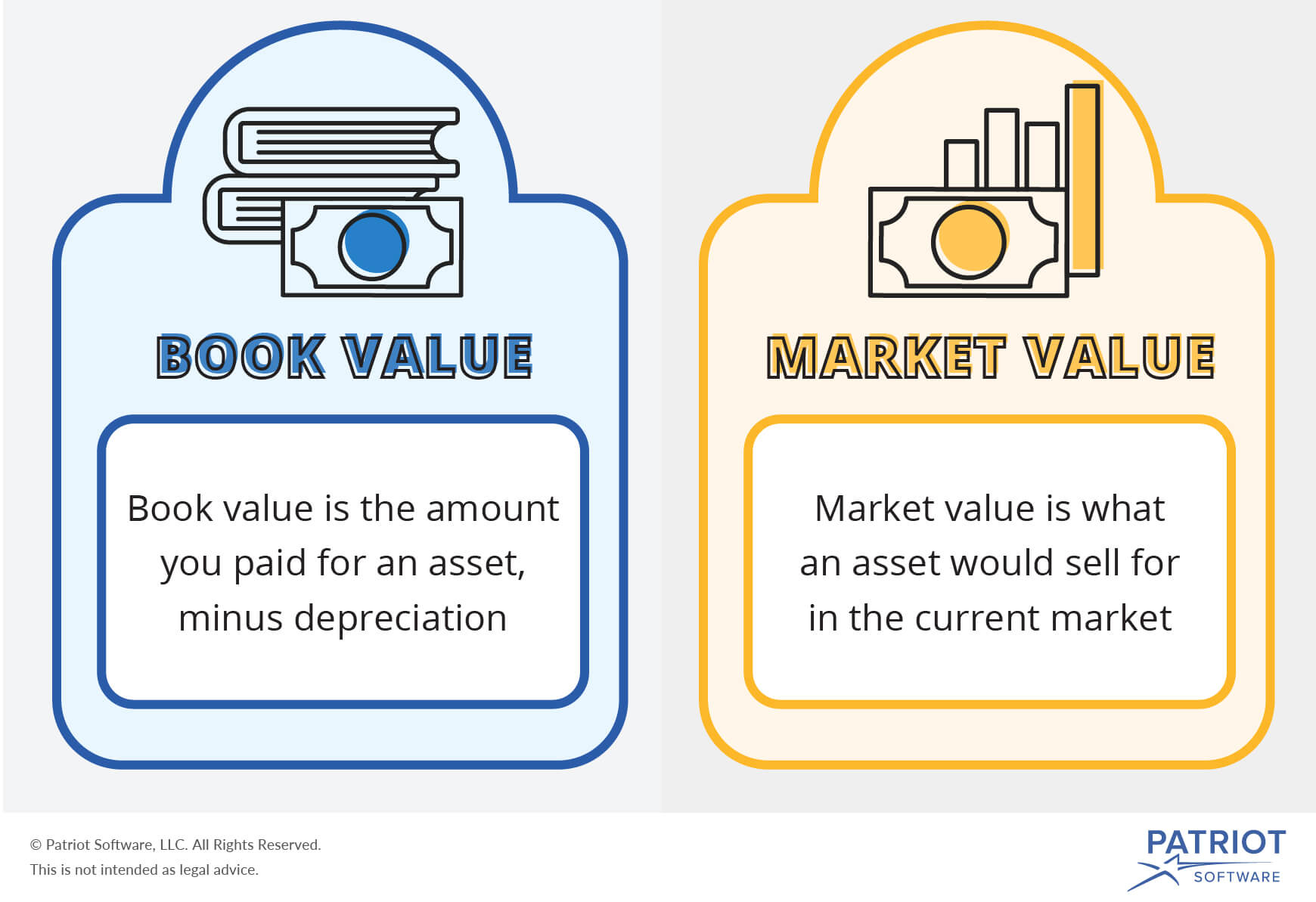

Your account books dont always reflect the real-world value of your business assets. The expected net settlement amount of the liabilities is equal t Of the total liabilities P60 represent secured and priority claims. C the asset is fully depreciated.

On the other hand the recoverable amount of an asset refers to the maximum amount of cash flows Cash Flows Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. The carrying value of an asset is the figure you record in your ledger and on your companys balance sheet. The assets are expected t 90 of carrying amount.

Replacement cost of the asset. Question 10 1 point The difference between a depreciable assetes cost and its residual value is called the. If the economic benefit will not be taxable the tax base of the asset will be equal to the carrying amount of the asset.

Assets fair value less its original cost. The lessor recognizes any initial direct costs as an expense if there is a difference between the carrying amount of the underlying asset and its fair value. An item of property plant and equipment is acquired it is recognized at its historical.

It proves to be a prerequisite for analyzing the businesss strength profitability scope for betterment. The market value of an asset on the other hand depends on supply and demand. A loss equal to the cash given up.

When a fixed asset ie. Question 51 The carrying amount of an asset is equal to the a. Blue-book amount relied on by secondary markets.

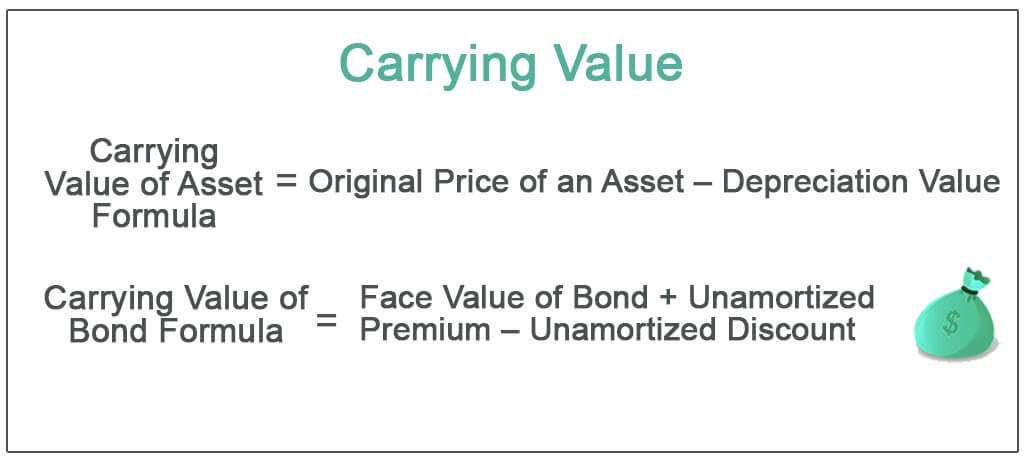

Assets cost less residual value. Carrying amount is the value of an asset as it appears on the balance sheet and is acquired after deducting its accumulated depreciation and impairment expenses. A corporation has Bonds Payable of 3000000 and Unamortized Discount on Bonds Payable of.

Original carrying amount c. The carrying value of an asset means its book value. Present value of expected cash flows.

This method is the simpler of the two alternatives. The carrying amount is equal to the cost of the asset less the accumulated depreciation. The fair value of land is reliably determined to be 2800000.

The assets acquisition cost less the total related amortization recorded to date. Transcribed image text. The carrying amount of an intangible is.

At reporting date the carrying amount of a cash generating unit was considered to be have been impaired by 1000000. The net free assets are P40. - Total net assets.

The assessed value of the asset for intangible tax purposes. The fair value of the asset at a balance sheet date. It equals the original cost or revalued amount of the asset minus accumulated depreciation and accumulated impairment loss if any.

Liabilities secured and priority 60 Free assets 30. A company has a truck that has its cost of 50000 in its account entitled Truck. Carrying amount and market value differ in many ways as listed below.

If the economic benefit will not be taxable the assets tax base will be equal to its carrying amount. At realizable value 90 Less. Assets cost-plus residual value less accumulated depreciation.

An assets book value is equal to its carrying value on the balance sheet and companies calculate it by netting the asset against its accumulated depreciation.

Capital Lease Obligation In 2021 Financial Management Learn Accounting Bookkeeping And Accounting

Image Result For Factoring For Finance Finance Accounting And Finance Business Finance

Instead Of Having A Bunch Of Stuff But Struggling In Debt Or Broke Most Of The Time Invest In Yo Investing Pinterest Business Strategy Small Business Growth

/GettyImages-1091470486-5b4ac16f07264b1a8b3738289324bfe5.jpg)

Carrying Value Vs Fair Value What S The Difference

Advantages Disadvantages Of Hypothecation Accounting And Finance Financial Strategies Financial Analysis

Accounting And Finance Ppt Bec Doms Bagalkot Mba Finance Accounting And Finance Economics Lessons Accounting

Strategic Communication Plan Template Beautiful Top 5 Resources To Get Free Stra Strategic Planning Template Business Plan Template Communication Plan Template

Saudi Company Signs Mou To Invest In 12 Billion Real Estate Project In Pakistan Investing Street View Offshore

Ltm Revenue Money Management Advice Financial Strategies Financial Analysis

Capital Lease Obligation In 2021 Financial Management Learn Accounting Bookkeeping And Accounting

Carrying Value Definition Formula How To Calculate Carrying Value

What S The Difference Between Book Value Vs Market Value

3 Stocks That Have Soared As The Market Sank Are They Buys Now The Motley Fool In 2022 The Fool The Motley Fool Motley

General Ledger With Budget Comparison General Ledger Budgeting Financial Management

Carrying Amount Definition Formula How To Calculate

Carrying Value Definition Formula How To Calculate Carrying Value

/pen-and-coins-on-financial-statement-1041019842-3fb97638d9f24424b156c88410a51848.jpg)